No Competition: Structural barriers to new construction enhance landlord pricing power

There are a variety of structural barriers to building new light industrial space that limit its stock growth. Light industrial assets are typically found in dense, inner-ring urban locations, where land prices and local zoning regulations contribute to prohibitively high development costs. Having a smaller building footprint further exaggerates the development costs: the smaller footprint results in lower building values to offset permitting, design, and engineering costs, rendering most projects economically infeasible. The dearth of light industrial development presents owners with an opportunity to exercise pricing power over an increasingly captive tenancy.

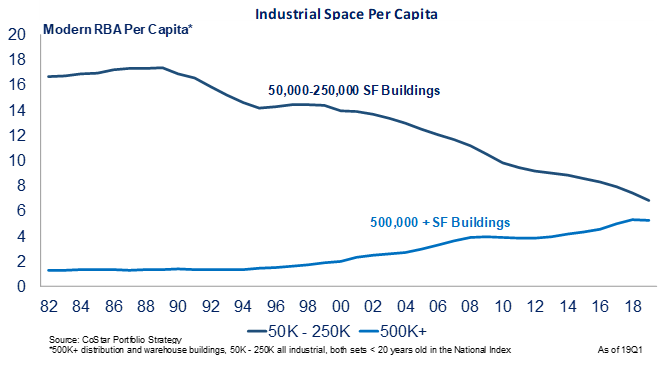

As a result of these supply barriers, light industrial development has not kept pace with US population growth, as evidence by a steady decline in square footage per capita[1]. This trend has continued in the current economic expansion cycle despite strong demand growth and acute investor interest, including a development boom in the bulk warehouse product type. Despite growing tenant demand for space, light industrial stock remains stubbornly low – and falling – relative to the population it is serving. The lack of new competitive light industrial space positions landlords to maintain pricing power and high levels of occupancy for the foreseeable future.

Please contact industrialresearch@gid.com for additional information.

[1] CoStar Group, 19Q1