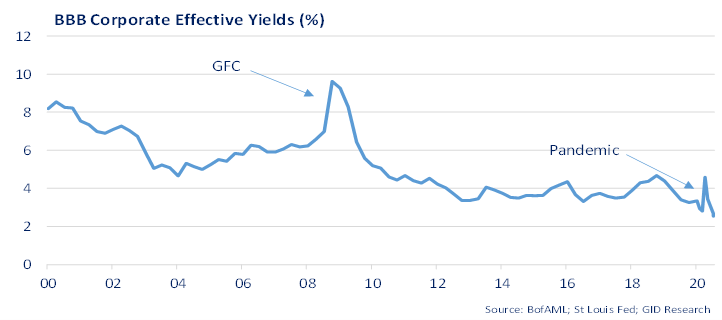

Bond Yields at Record Low: Relative to BBB bonds, CRE looks historically cheap

The Fed was prepared to move quickly, applying hard lessons learned during the financial crisis 10 years ago to support credit markets during the economic shock of the pandemic. These efforts complement pre-CoVid trends of structurally low bond yields that reflected relatively weak, demographic-driven, long-term growth prospects, a global savings glut, and commensurate search for yield. As a result of these structural trends and Fed efforts, credit markets remain open, liquid, and attractively priced for qualified borrowers. For example, BBB corporate bond yields, which reflect average credit risk, have fallen to historic lows.

The availability of cheap capital lends support to real asset values:

- Low bond yields have translated into record low borrowing costs, supporting valuations.

- Relative to BBB bond yields, commercial real estate looks historically cheap. The spot market risk premium to own commercial real estate is historically wide at about 180 bps, compared to the 20-year average of 69bps. For multifamily properties, the spread to BBB bond yields exceeded 160 bps, about double the average since 2010 of 78 bps[1]. All else equal, this should help pull in capital seeking relative value and put downward pressure on cap rates.

- With investors assured of structurally low interest rates, any pandemic related value losses for multifamily or industrial will likely track income declines, not a sharp repricing of cash flows (i.e. cap rate expansion) as seen during the GFC.

GID recognizes that defaults lag economic disruptions and bond yields could widen again. However, GID believes that any widening of credit spreads will be temporary and that a structurally low interest rate environment will persist. Meanwhile, qualified and well-capitalized borrows are uniquely positioned to lock in attractive debt yields today, helping to amplify returns and supporting valuations.

Please contact research@gid.com for additional information.

[1] BBB corporate bond yields were 2.54% on 7/9/20; NCREIF CRE appraisal based, value-weighted cap rates were 4.37% and multifamily cap rates were 4.17% as of Q1 2020.